Times Interest Earned Ratio Interpretation

Interpretation of the Fixed-Charge Coverage Ratio. Average Collection Period.

Times Interest Earned Ratio Formula Examples With Excel Template

And unlike net income it is difficult to play around with this variation of earnings per share ratio.

. EB optimal capital structure PG HA Times interest earned TIE EBIT Interest expense Ability to meet interest payments as they mature. The formula used for the calculation of interest coverage ratio is-. The bank could have additional interest expenses on the income statement but well keep this example simple.

For example if a companys earnings before taxes and interest amount to 50000 and its total interest payment requirements equal 25000 then the companys interest coverage ratio is two. The average collection period is the approximate amount of time that it takes for a business to receive payments owed in terms of accounts receivable. Net Interest Investment Returns Interest Expenses 60000 50000 10000.

In simple terms the earning assets are. The fixed-charge coverage ratio is regarded as a solvency ratio because it shows the ability of a company to repay its ongoing financial obligations when. From 2008 to 2010 Revenues increased by 558 64306 in 2010 versus 60909 in 2008.

The higher the ICR the lower the risk. Generally a ratio of 2 or higher is considered adequate to protect the creditors interest in the. However Interest Coverage Ratio decreased from 1955 times in 2008 to 963 times in 2010.

Earnings per share ratio formula. PG HA ROT minimal 2-4 CFO to interest. -The times interest earned ratio sometimes called the interest coverage ratio is a cov-erage ratio that measures the proportion-ate amount of income that can be used to cover interest expenses in the future.

Book Value earnings per share ratio. The interest coverage ratio is used to determine the solvency of an organization in the nearing time as well as how many times the profits earned by that very organization were capable of absorbing its interest-related expenses. The history of banking began with the first prototype banks that is the merchants of the world who gave grain loans to farmers and traders who carried goods between cities.

The FCCR is used to determine a companys ability to pay its fixed payments. In the example above Jeffs salon would be able to meet its fixed payments 417 times. Limitations of Interpretation of Debt to Equity Ratio.

Significance and Interpretation. Times interest earned ratio is very important from the creditors view point. Cash earnings per share ratio Operating Cash FlowDiluted Shares Outstanding 5.

Interpretation of Earnings per share ratio. This was around 2000 BCE in Assyria India and SumeriaLater in ancient Greece and during the Roman Empire lenders based in temples gave loans while accepting deposits and performing the change of. A high ratio ensures a periodical interest income for lenders.

This ration variation calculates the. The ideal debt to equity ratio will help management to make expansion decisions for further growth of business and increase its share in the market by adding more units or operations. Now we must calculate the average earning assets for the period.

EBIT is sometimes called Operating Income. Some of the Limitations of Interpretation of Debt to Equity Ratio are. It is important to note that a higher Interest Coverage Ratio is a.

The companies with weak ratio may have to face difficulties in raising funds for their operations. In some respects the times interest ratio is considered a solvency ratio because it measures a firms ability to make interest and debt service payments. It gives the exact amount of cash earned.

The net interest is calculated as follows. Thus the investors and lenders prefer lending money to entities with a higher ratio as they know the latter is capable of. This ratio using the averages of the balance sheet accounts to facilitate our ratio decomposition.

Times Interest Earned Ratio Formula Plan Projections

Times Interest Earned Ratio Meaning Formula Calculate

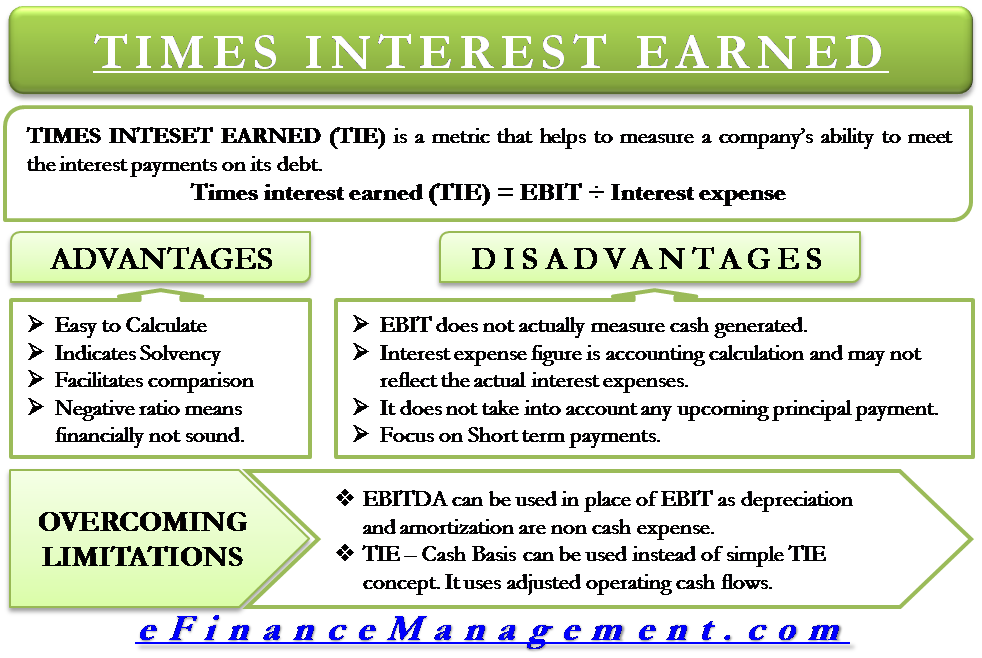

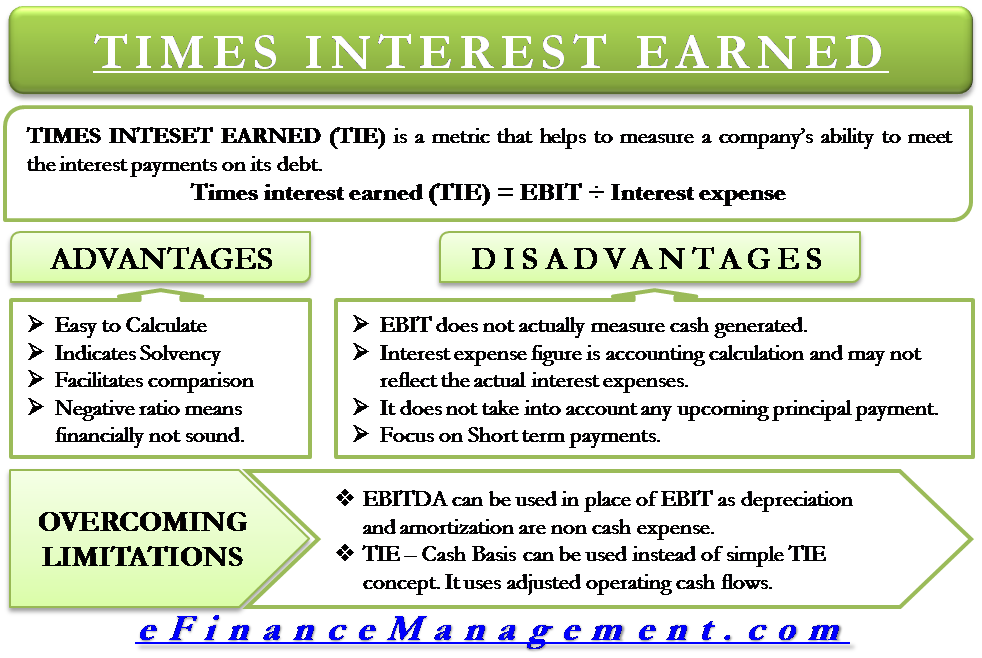

Times Interest Earned Formula Advantages Limitations

Times Interest Earned Tie Ratio Formula And Calculator

Times Interest Earned Ratio Debt To Total Assets Ratio Analyzing Long Term Debt Youtube

Comments

Post a Comment